Digital cryptocurrency wallets or better known as Wallets, is the application or tool that allows us to manage or administer our digital assets that we have acquired from a platform or that have been sent to us. It can work as a virtual application operating through software or physically through specialized hardware, with this tool users who own cryptocurrencies can carry out operations to send or receive crypto assets through the different chains of blocks that exist. currently.

And it is that it is perhaps one of the most important elements within the cryptocurrency ecosystem. It is a tool that every person associated with cryptocurrencies must have and know how to use, since it is essential for the management of our cryptocurrencies, which is why each person must know how to choose a wallet according to their own context.

When we talk about wallet we refer to a digital wallet, portfolio or purse where we can manage digital assets such as cryptocurrencies, tokens and other cryptographic assets such as NFT’s, it can have different variations since not all of them allow the use of the same assets, some are designed for manage only one currency and others are created to be adaptable.

As we mentioned before, wallets are one of the most used tools by crypto users since they allow the management of these digital assets and also the sending or receiving of them. But have you ever thought about the inner workings of this digital tool? It is that many really know how to use it, but perhaps they do not know the internal process with which cryptocurrency transactions are carried out.

As we already know, the financial system that we have been using in our day to day, works through a global system of central banks that are in charge of issuing new banknotes and coins, as well as controlling interest rates and economic policies of each country. Unlike this traditional system, cryptocurrencies such as Bitcoin, among others, are characterized by being totally digital, they have no representation in the physical world and are totally based on mathematical processes based on cryptography.

Because of this immaterial characteristic that wallets are so important, being such a precious asset, everyone has the need to keep it in a safe place, just as we do with our money in banks.

But unlike physical money and banks, in the wallets we do not keep “digital currencies” but we really safely record the public and private keys, and although it sounds a bit strange we do not keep our cryptocurrencies in our wallets but a record of the transactions that are made with them, remember that the Blockchain network operates with a series of nodes spread throughout the world that are in charge of storing and serving as a channel for the transmission of information, each transaction that we make with our cryptocurrencies is registered in the chain of blocks, and part of this record is stored within our wallet, which tells all users of the network that we are the owners of a certain amount of any cryptocurrency and we can use it whenever we want (public key and private key).

Public Key: When we talk about public keys, as the name indicates, we are talking about an address that we can give to anyone interested in sending us a particular cryptocurrency, a very common simile of this dynamic is the comparison with the numbers that represent our bank account, but public keys do not work with a numerical series but with a long series of an alphanumeric code, which can also be represented as a QR code. With this code we can generate addresses to receive funds in our wallet, consult and see our funds in real time.

Private Key: With the same simile of the banks, the private key is like our bank key, with which we can withdraw money from an ATM or with which we make purchases with our debit card; It is a key that should not be revealed to anyone, since whoever has access to this key will be able to do whatever they want with the funds registered in a wallet.

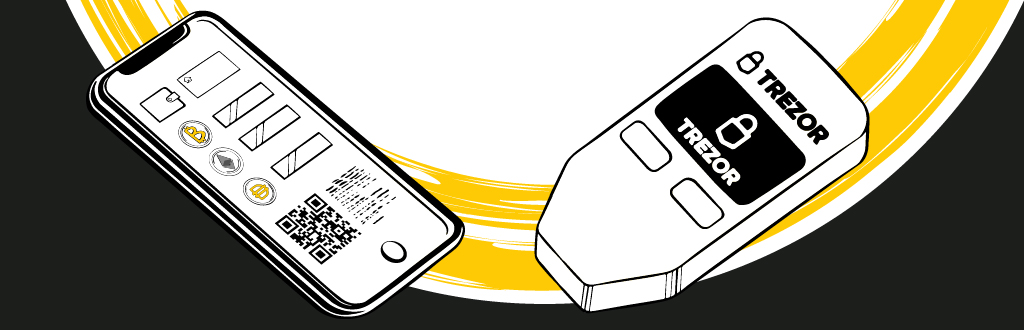

Currently we can separate wallets into two types, physical wallets and virtual wallets, each type has a characteristic that defines it compared to its counterpart. In addition to this separation, it should be noted that it can also be classified in other ways, such as according to the amount of cryptocurrencies they support, or by their security.

Are all those wallets that work by physical means such as computer equipment or specialized hardware in the encryption process, they are the most secure wallets since they give the user free use and protection of the public and private key, in addition, most of the time they are offline, therefore the risk of hacking is not a problem, however, their own security design can play against it, since if a user of this type of wallet does not protect or forgets the words If you ever lose or damage your wallet, you are in danger of losing everything you have stored.

They are the most common cryptocurrency wallets, since they allow users to download and install them on different devices, they are much more versatile than physical wallets since they are always at hand, but many have the risk of a security breach through hacking, however most wallets today are very secure. One of the main criticisms of this type of wallet is that there are wallets that do not give the user full control of the private key.

This is because they are very versatile when it comes to using them, as it simplifies their use for less experienced users, and also because despite not being as secure as physical wallets, their level of security is very high.

One of the things that makes physical wallets so uncomfortable for certain people is that all the responsibility falls on the user, since the wallet is in charge of giving them all the tools and instructions to follow to use it, but if the user is not careful and forgets something as important as the recovery words, you may risk losing everything stored in the wallet.

Almost all wallets have a recovery or backup system, as a general rule this system consists of giving the user a series of 12 random words that have a specific order, with these words the user can recover everything they have stored in a virtual wallet or physical, in case it is deleted or uninstalled (virtual) or stolen, lost or damaged (physical), for this reason it is vitally important that all users of any wallet safeguard these words correctly and safely.

Have a spectacular day!

MegaAcademy is developed by CCoins. Copyright ©2023 CCoins Lab. All Rights Reserved.

| Total |

0

|

| Coupon | |

| Descuento |

0$ USD |